Newsletter (not only) for brokers - Change of the designation of the community property, Changes in the notification of the contact person from 1.2.2025, Purchase price discount for defects in the property, How to calculate the purchase price discount?

New in the Land Registry: change of designation of the community of property

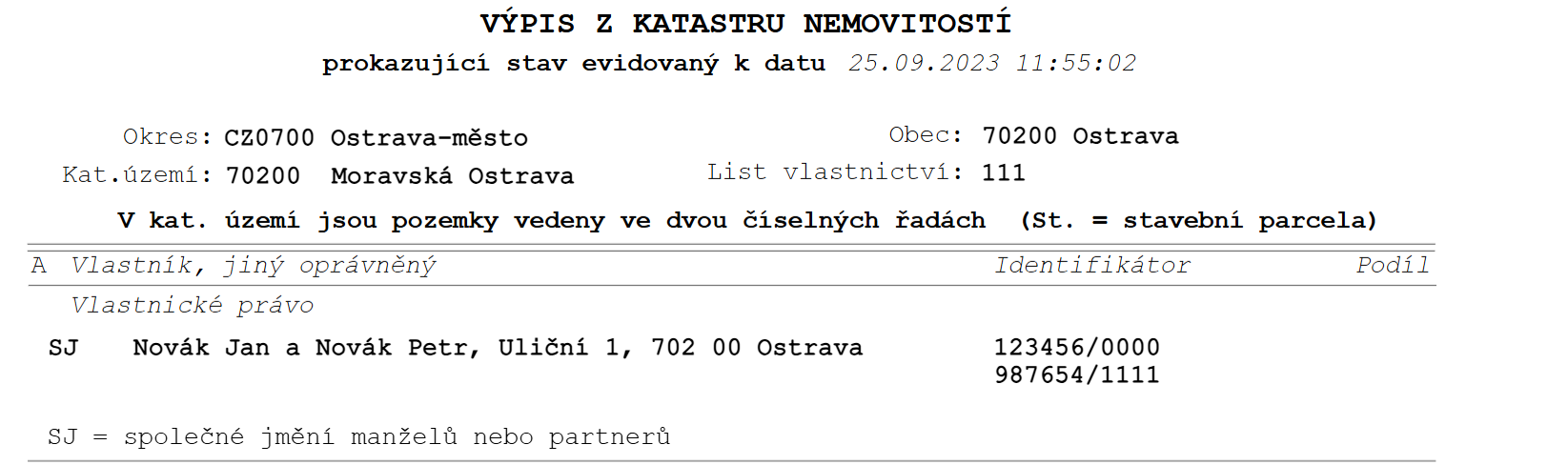

As of 1 January 2025, the designation of the community of property will change on the real estate register extracts. The existing abbreviation "SJM" (community property) is now replaced by the universal abbreviation "SJ" (community property).

This change is related to the amendment of the Civil Code, which introduces the institution of partnership as an equal union of two persons of the same sex. Partners will have the same rights as spouses, including the possibility of acquiring real estate as community property.

The abbreviation "SJ" will therefore be a uniform designation for the community of property of spouses and partners. As real estate agents, you should be prepared for this change so that you can interpret the Land Registry data accurately and without error.

Author of the newsletter: ARROWS (Mgr. Barbora Slaninová, JUDr. Lukáš Slanina, Mgr. Robert Dürrer, office@arws.cz, +420 245 007 740)

Changes in contact person notification from 1.2.2025

On the basis of the amended Section 22 of the AML Act, the scope of information provided to the Financial Analysis Office (FAO) by real estate intermediaries on the designation of their contact person, as well as the method of notification, has changed with effect from 1 February 2025.

What is the content of the notification of the contact person?

- the name of the contact person

- the job title of the contact person (must be an employee or member of the statutory body of the estate agent)

- contact details, including telephone and electronic contact details (must be functional)

- the times when this person can be contacted

- what type of obliged person is involved - i.e. real estate intermediary (according to Article 2(1)(d)(2) of the AML Act)

The real estate intermediary shall fulfil its obligation regarding the notification of the contact person only through its data mailbox and exclusively only through the prescribed interactive form, which is made available on the FAU website https://formulare.fau.gov.cz/ as of 1 February 2025 . The deadline for compliance is within 30 days from the date on which the estate agent became an obliged person or within 15 days from the date on which there are changes in the data subject to the information obligation.

The above obligation under the new rules must also be fulfilled by real estate intermediaries who have already complied with the notification of the contact person previously, by 3 March 2025 at the latest, due to the change in the scope of information provided regarding the contact person and the method of notification.

Decision: Purchase price discount for defects in the property

A recent decision of the Supreme Court of the Czech Republic (Case No. 23 Cdo 201/2024) has brought clearer insight into the rules for determining the discount on the purchase price of real estate. The key message is that the amount of the discount on the purchase price ≠ the costs incurred to repair the defect.

The purpose of defective performance rights is not to compensate for the damage caused (for which other legal instruments are available), but to restore the balance between what the buyer paid for a property he considered to be faultless and what he actually received from the seller.

Helpful hints: How to calculate the discount on the purchase price?

So how do I calculate the discount on the purchase price? Usually, the so-called relative method of calculation can be used. The procedure is as follows:

- find out the market value of the property without defects (this may not correspond to the agreed purchase price).

- Find out the market value of the property with the defect.

- Calculate the ratio between these values.

- Apply this ratio to the agreed purchase price to obtain the amount of the discount.

Example: a property sold for CZK 5 000 000 had a market value of CZK 4 500 000 due to inadequate waterproofing. However, without this defect, its market value would have been CZK 6 000 000. The calculation of the discount would be as follows:

- Ratio: 4 500 000 ÷ 6 000 000 = 0,75

- Discount: 5 000 000 × (1 - 0,75) = CZK 1 250 000

- Resulting discount: CZK 1 250 000

This approach ensures fair compensation between the parties and takes into account the purchase price originally agreed between the parties. However, in some cases it may not be fully applicable. Therefore, the specific circumstances of the case should always be taken into account and the procedure adapted if necessary.